Affordability continued to decline, but the bottom has been reached.

Affordability continued to decline, but the bottom has been reached.- Apartments still unaffordable in Tallinn and Vilnius.

- Interest rate burden remains heavy, but there are first signs of rates inching down.

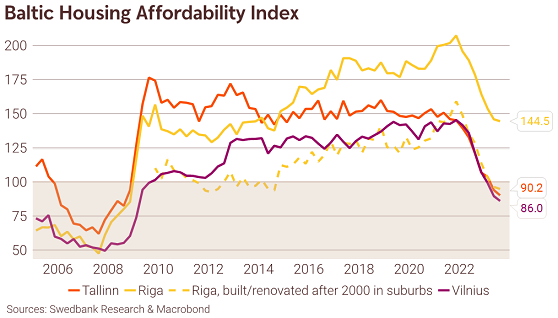

Housing affordability continued to decline in the third quarter of 2023, albeit at a slower pace. The good news – we expect that after 10 consecutive interest rate increases, the ECB hiking cycle is done, and the first tentative signs of lower mortgage rates were already observed as the 6-month EURIBOR peaked in October and has been slowly declining thereafter. Housing is still unaffordable in Tallinn and Vilnius, while Riga remains somewhat resilient, largely thanks to the comparatively low and declining prices of Soviet-era apartments, which make up the majority of Riga’s market. The Riga apartments that were built or renovated after 2000, however, are unaffordable for average earners.

Market activity remains muted, with transaction numbers and reservations at relatively low levels. Consumer confidence, shaken by high inflation and the subsequent higher interest rates, remains below the long-term average in Latvia and is especially downbeat in Estonia. This is different in Lithuania, where households feel rather upbeat and optimistic. Estonian households are more worried about losing their jobs and the future financial situation than their Baltic neighbours. As the primary housing market has become out of reach for most households, reflected in scarce demand, real estate developers are resorting to discounts and diverse marketing strategies to attract buyers. As a result, price growth in the primary market continued to slow down in Q3, while prices in the secondary market decreased.

Looking ahead, the high-interest rate environment is unlikely to persist, as economic slowdown is observable across numerous EU countries. Economic weakness and clear disinflation trends will likely allow the ECB to declare victory over inflation and start cutting rates in April next year. We forecast that the policy rate will gradually decrease, reaching 2.5% at the end of 2024. With such changes, both housing affordability and market activity should improve. However, we do not expect a very rapid recovery in the number of transactions, and prices are expected to be stable throughout 2024.