Card spending shows that people are slow in adjusting their spending habits despite collapsing purchasing power

Card spending shows that people are slow in adjusting their spending habits despite collapsing purchasing power- Card turnover, adjusted for inflation, has started limping in recent months

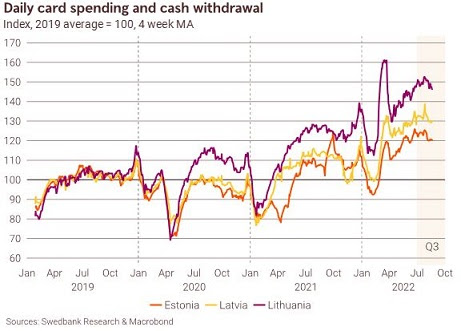

People keep spending considerably more than last year or before the pandemic and absorbing stubbornly high inflation. Even though they are wary about the future, it seems that many if not most are unwillingly and only slowly adjusting their consumption habits in the face of soaring prices. Tired from pandemic curbs, cautiousness, and boredom over the past couple of years, people are celebrating the lift-off of restrictions by unleashing their spending on enjoyment and relaxation.

Job growth and wage uptick have helped prop the spending up. However, the wage gains fell short of consumer price growth in the Baltic economies already in spring. The decline in the purchasing power has worsened to almost 10% since then. In some cases, to prolong the celebration, in other cases, to cover the needs expenses people have reduced their savings rate, and we also see some uptick in borrowing for consumption purposes.

Tightening inflation grip has started to weigh on consumption though. Although, the nominal card turnover is still growing at a double-digit year-on-year rate, adjusted for changes in prices, it decreased in June and July in all the Baltics. The fall and winter months are likely to be gloomier, as we enter the heating season with higher utility bills.