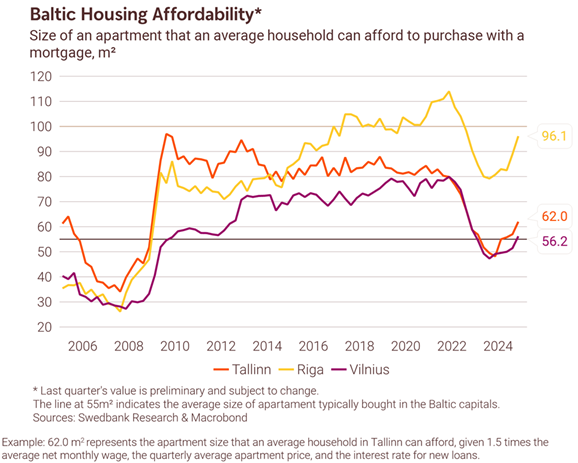

Housing affordability increased due to lower interest rates, as well as still-solid wage growth.

Housing affordability increased due to lower interest rates, as well as still-solid wage growth.- Improving economic conditions should fuel market activity in 2025 and thereafter.

The year 2024 ended, and 2025 has started on a positive note for the Baltic housing markets. Housing markets benefitted from four ECB rate cuts last year, plus one more in January, resulting in a 1.25 pp decline altogether. Furthermore, wage growth remained strong and outpaced housing price increases. These factors became the key drivers of improved housing affordability across all Baltic capitals.

Increased affordability, and higher consumer confidence (in Latvia and Lithuania) boosted market activity. Swedbank forecasts suggest that all three Baltic economies will see strong wage growth and high employment this year, which should ensure that the housing market recovery continues.

We forecast four more ECB rate cuts this year, which will further improve housing affordability in all Baltic capitals. Mortgage refinancing activity is very high in Lithuania and Latvia, which will put even more downward pressure on average interest rates. Furthermore, rising net wages will continue to support affordability in Latvia and Lithuania. Yet, storm clouds, in the form of Donald Trump, are forming over our heads. Heightened geopolitical tensions could raise uncertainty for households, motivating them to postpone home purchase.

This time the appendix of the report also contains graphs offering an insight on data on Swedbank’s new mortgage-takers.