- The surge in supply has almost halted price growth

- Construction sector investments low

- Real estate prices relative to income stay below 12-year average

Price – it is all about demand and supply

In the first quarter of 2016, price growth of apartments in Estonia almost came to a halt due to increased supply. Even though 6,000 dwellings have been added in Tallinn in the last five years, the ratio of individuals per dwelling has been on the rise. In Tartu, the second-biggest city in Estonia, the situation is less tense. Price pressure has been fiercer in Tallinn and the difference between price per square meter in Tallinn and Tartu has increased from 50 to 350 euros.

In the second quarter of 2016, annual price growth accelerated to 1.8%, a notch up from first quarter result of 0.7%, but in general, the market has stabilised, whereas the median price has a clear trend downwards. Due to increased supply and sale adverts of newer dwellings, competition has pushed down the prices of newer apartments, making them more attractive. As interest rates are low and newer houses have lower maintenance costs, the extra a customer has to pay to cover the price difference with a loan has decreased to a marginal value.

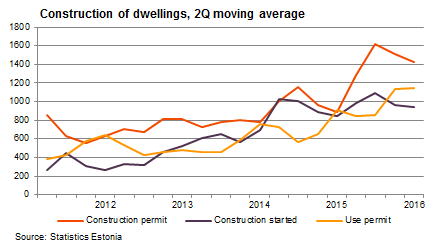

Low investments in the construction sector

The drop in the prices of new apartments is good news for potential clients, whose income has grown substantially and now exceeds real estate price growth. Wages have grown in the construction sector as well. This, combined with lower sales prices, has hit investments of construction companies.

Is the price of real estate too high?

Apartment prices are closing in to the level of the 2007 real estate boom in nominal terms, —they are only 12% lower on average. The situation is not even close to the conditions of the 2007 real estate boom when prices are compared to income. Prices relative to income have recovered from the bust that followed the boom and stay below the 12-year average level. In fact, they even dropped in the first quarter of 2016. Whereas in 2007 the average worker needed to pay 2.5 times the average net salary to buy one square meter of apartment space, he/she now needs only 1.7 average net wages in a given region.

We expect that this year the prices of real estate will stay relatively stable. Low interest rates continue to support demand for dwellings and lending growth. The amount of started construction projects should keep up the necessary supply of new dwellings.