With interest rates falling faster than expected and wage growth remaining strong, housing affordability gradually improves.

With interest rates falling faster than expected and wage growth remaining strong, housing affordability gradually improves.- Both factors will continue boosting affordability and demand in Latvia and Lithuania next year, while Estonia will rely solely on lower rates.

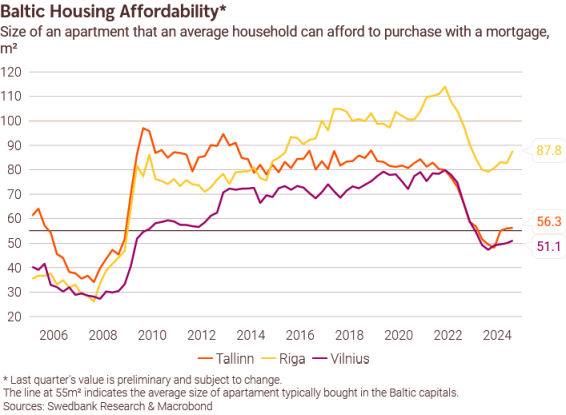

Favourable inflation readings and a weak economy have already led to three rate cuts by the ECB. Paired with strong wage growth, this has improved housing affordability in the third quarter in the capitals of the Baltic states. Affordability in Riga was supported also by a slight decline in average market price. An average-sized apartment in the primary market, however, remains out of reach for the average household across the Baltics.

Market activity is picking up, while the number of transactions per capita is nearly identical across the cities. Consumer confidence in Lithuania and Latvia continued to improve, yet it waned in Estonia after a promising start to the summer.

We expect another 25-basis-point rate cut by the ECB in December. The deposit rate, which is closely followed by the EURIBOR, will gradually decline to 1.75% by next September – the expected low point in this cutting cycle. Therefore, lower rates are likely to continue to boost activity and housing affordability in the Baltic countries. Tax changes in 2025, however, will differentiate the pace of recovery. Higher taxes will result in comparatively negligible net wage growth in Estonia. Conversely, in Latvia, the shift from a differentiated to a fixed non-taxable minimum will push net wage growth up. In both Latvia and Lithuania, net wage growth is expected to exceed 8% – lower than before, yet still a rapid tempo.